Executive Summary

At the time of writing, Laurent-Perrier trades at €119 per share, with a market cap of €704 million and an enterprise value of €908 million, factoring in 5.92 million outstanding shares and €204 million in net debt. FY22 earnings stand at €9.89 per share, and H1/23 reports €6.52 per share (versus €6.34 in H1/22). The FY22 PE ratio is 12x compared to its historical mean of 20x (going back to 2006). Comparatively, industry peers like Rémy Cointreau (17x FY22 PE - 27x LTM), Pernod Ricard (17x FY22 PE), Davide Campari (34x FY22 PE), and LVMH (22x FY22 PE) exhibit significantly higher valuations.

The company tripled its EPS over the past decade through enhanced pricing, a favorable product mix, and expanding margins driven by increased premium sales. Over this period, dividends totaled €13 per share, and net debt was reduced by €17 per share, along with modest stock buybacks. I believe that the company will be able to sustain similar EPS growth into the future through ongoing price/mix improvements and a continued focus on premiumization. Given the luxury sector's resilience and the enduring strength of the brand, I expect the company's valuation to align with its historical and industry average of approximately 20x EPS. Should EPS continue to rise in line with the past decade, while the valuation discount closes, and FCF is distributed to shareholders in one form or another, potential returns of 15% CAGR could be achieved. The downside is protected by a tangible book value of €92 per share, with inventory valued at €115 per share; and since inventory is recorded at cost, and champagne increases in value with age, the inventory itself offers hidden value.

Company Overview

Laurent-Perrier is a renowned French champagne house with a rich history and a global reputation for producing high-quality champagne. Founded in 1812, the company has a legacy of over two centuries in crafting exquisite champagnes. Laurent-Perrier is headquartered in Tours-sur-Marne, in the Champagne region of France. Only wines produced in the Champagne region of France can be labeled and sold as “Champagne”.

Laurent-Perrier is one of the rare family groups of champagne houses which is listed on the stock market, and which is exclusively dedicated to champagne, and focused on the high-end market. The Group is controlled by the de Nonancourt family, which holds 65.12% of its capital and 78.23% of its voting rights.

Investment Thesis

Champagne supply is limited and highly regulated: Champagne is limited by geographical and regulatory factors. True Champagne is a sparkling wine produced exclusively in the Champagne region of France and its production is tightly regulated by French law.

Geographical Indication: The term "Champagne" is protected by an Appellation d'Origine Contrôlée (AOC) designation, which means that only sparkling wine produced in the Champagne region of France can be labeled as Champagne. This restricts the geographical area where Champagne can be made, limiting its production to a specific and relatively small region of 34,200 hectares.

Specific Grape Varieties and Qualities: Champagne production typically involves specific grape varieties, with Chardonnay, Pinot Noir, and Pinot Meunier being the primary grapes used. The combination of grape varieties, soil, and climate conditions unique to the Champagne region contributes to the distinct characteristics of true champagne.

Grapes are graded according to a quality rating expressed as a percentage. The minimum grade is 80%, the maximum is 100%. Champagne is a grand cru, if it is produced exclusively from grapes graded 100%, and a premier cru, if produced from grapes graded from 90-99%.Maximum Yield: A maximum grape yield per hectare is set each year and may not exceed 15,500 kg per hectare.

Ageing: Non-vintage champagne needs to age at least 15 months from bottling, while vintage champagne needs to age a minimum of 3 years. Champagne gets more valuable and desirable with age.

Strict Production Standards and Traditional Production Methods: Champagne production is subject to strict quality standards and regulations outlined by the Comité Interprofessionnel du Vin de Champagne (CIVC). The traditional method of producing champagne, known as méthode champenoise or méthode traditionnelle, involves a labor-intensive process of secondary fermentation in the bottle. This method, along with the aging requirements, adds complexity to production and contributes to the overall limited supply.

Exclusivity and prestige associated with true champagne: Other regions and producers may make sparkling wine using similar methods, but they cannot label their product as Champagne unless it adheres to the specific regulations governing the Champagne AOC.

Champagne is a luxury good with Veblen characteristics

The demand for Champagne is influenced not only by its taste and quality but also by its association with luxury, celebration, and social status. As the price of Champagne rises, some consumers are more inclined to purchase it because of its higher cost, viewing it as a symbol of prestige and exclusivity.

The consumption of Champagne is often linked to special occasions, celebrations, and conspicuous consumption, making it a product where the perceived value is tied to its higher price. People may choose more expensive Champagne brands or vintages not only for the taste but also as a status symbol or to make a statement of luxury.

LPE is family-owned with a long-term focus

The Group is controlled by the de Nonancourt family, which holds 65.12% of its capital and 78.23% of its voting rights.

The family has a very focused, long-term approach. Their singular focus is making and selling premium champagne, particularly of the high value-added kind that is part of the luxury goods universe rather than the consumer products universe. They’re willing to sacrifice volume in favor of increased ASP to elevate the Group’s Brand(s) and ultimately make LPE a more profitable business.

LPE is successfully executing a premiumization strategy

Industry-wide, the average selling price (ASP) of a champagne bottle has risen by 1.4% annually since 2007 (from €15.82 per bottle to €19.44 per bottle) and 2.0% since 2009 (from €15.53 to €19.44).

Comparatively, Laurent-Perrier's ASP increase has outpaced the industry, growing by 2.6% per year since 2007 (€17.56 to €25.79) and 3.4% since 2009 (€16.68 to €25.79).

Share of premium sales for LPE has risen from 39.4% in 2007 (and 35.0% from 2009) to 44.3% in 2022, contributing to an increase in gross margin from 53.1% in 2007 (and 49.7% in 2009) to 57.5% over the same period.

These gradual improvements in LPE’s business, apparent over an extended timeframe, might not be fully recognized by the short-term-focused stock market.

Brand Heritage and Lindy Effect

The company has been around for more than 200 years building brand value and heritage. It will likely continue to be in business for at least the next 200 years.

The same can be said about champagne as the beverage of choice for celebration.

LPE trades at a compelling valuation

Valuation

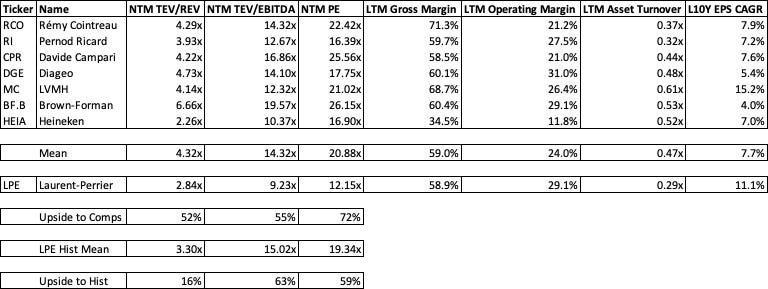

I've included two comp tables in this valuation analysis: Table 1 shows a potential upside of 50-70% if valuation catches up to other premium wine and spirits makers, representing the bull case. Table 2 shows other listed champagne pure plays, all of which are visibly cheaper than the peer group from Table 1. While there's a chance that this valuation gap persists, I believe that LPE is a more premium player than both VRAP and ALLAN, executing its premiumization strategy more effectively, warranting a valuation premium (VRAP is also massively overleveraged with €650 million of net financial debt on a €150 million market cap - or 13x EBITDA). I argue that LPE should trade closer to the peer group from Table 1. The upside to its historical mean valuation going back to 2006 is upwards of 50% as well.

I forecast 8.9% annual EPS growth over the next decade, driven by some volume recovery in the short term and modest 1.0% per year long-term volume growth, continuous price/mix improvement at 3.5% annually, and gross margin expansion to 64% by the end of the forecast period. I expect operating expenses to rise by 3.5% yearly. Over the past decade, 61.9% of net income has gone to net debt reduction (33.8%), dividends (26.5%), and share buybacks (1.5%). For the forecast period, I’ve assumed no further net debt reduction. Instead, in addition to a continued 25% dividend payout ratio, I assumed that 35% of net income is used for share buybacks (modeled at 20x PE). Now this will certainly not be the actual capital allocation, but shareholders will profit in some form or another from the generated cash, whether it be via dividends, share buybacks, or net debt reduction.

In summary, I view 9-15% CAGR over the next decade as s realistic expectation range, comprising a 9% return through annual EPS growth (compared to 11% in the last decade), approximately 2% return via dividends, and another roughly 5% through a valuation increase from 12x EPS to 20x EPS by 2033. The downside is protected by a tangible book value of €92 per share, with inventory valued at €115 per share. Inventory is valued at cost, but since the value of champagne increases with age, the inventory is certainly more valuable than is accounted for.

Risks

Champagne Volume Stagnation:

Risk: Industry volume has remained flat/ slightly decreased since the last cycle peak in 2007 (339 million bottles in 2007 versus 325 million bottles in 2022).

Mitigant: Growth opportunities in export markets, along with sustained value growth, counterbalance volume challenges.

While the domestic market (France) is down from 188 million bottles in 2007 to 138 million bottles in 2022, the export market has grown from 151 million bottles in 2007 to 187 million bottles in 2022.

While volumes are slightly down since 2007 in aggregate, value has grown by 2.2% per year (€4.6 billion to €6.3 billion) or 4.2% per year since the last cycle trough in 2009 (€3.7 billion to €6.3 billion).

Cycle Peak Concerns/Over-Earning Perception:

Risk: LPE stock only looks cheap because the company is over-earning at a cycle peak.

Mitigant: Volumes are already down significantly since FY21 and this time around LPE is much better positioned than during the GFC.

During the GFC worldwide champagne volume was down by 13,6% from the peak in 2007 to the trough in 2009. For LPE volume went down by -27% from peak to trough and operating profits decreased by -57%.

This time around, volume for LPE was already down -7.9% in FY22 versus FY21. Operating profits were still up due to positive pice/mix effects. In H1/23, volume for the group was down -12.8% (important to note that H1/22 was positively impacted by COVID reopening), but operating profit was up +8.1%, due to offsetting price/mix improvements of +9,6%.

This time around the company is in a much stronger position because of its higher export and premium share.

(Note that many of the premium wine and spirits makers from Comp Table 1 are suffering from volume declines but have not managed to offset them in the same way with price/mix improvements and their stock prices have suffered significantly because of it and because of much higher starting valuations.)

Structurally low ROE

Risk: Champagne producers (but also some peers from Comp Table 1, e.g. Rémy Cointreau, Pernod Ricard, and Davide Campari) have relatively low returns on invested capital, predominately because they hold a lot of inventory (because of ageing requirements).

Mitigant: Current LTM ROE for LPE is 11%. If the price/mix continues to improve, ROE will improve alongside it. It’s also possible that LPE has some very old vintages in stock that are simply not contributing to earnings. One has to pay attention to returns on incremental invested capital going forward.

Climate Change and Grape Supply:

Risk: Climate change threatens grape cultivation, impacting quality and quantity.

Mitigant: A potential supply reduction due to climate change could position champagne as an even rarer and more desirable good, offering premium champagne brands like Laurent-Perrier a unique opportunity to further drive up the value of their offering.

Conclusion

Laurent-Perrier presents a compelling investment at €119 per share. Trading at historically low valuation multiples, and trailing valuations of industry peers, the stock holds significant upside potential over the long term. The company's fundamental track record, tripling EPS over the past decade, driven predominately by increased ASP, shows that the premiumization strategy is working. Anticipating the continued successful execution of this strategy, I forecast EPS to increase again over the next decade, in line with the growth of the past. Combining fundamental improvements and closing the undervaluation gap, I estimate a potential 9-15% CAGR over the next decade. The potential for an attractive upside is accompanied by significant downside protection, including the industry and brand's resilience, valuable inventory, and the long-term commitment of the family with a significant ownership stake.

An interesting idea and succinct write-up. But your assumptions seem far too bullish considering historical performance. https://open.substack.com/pub/johanlunau/p/laurent-perrier-lpe?r=u2hy6&utm_campaign=post&utm_medium=web. Curious about your thoughts on this!

Nice article! A crital note though. Historical profitability has been a lot lower than the recent good years. Wine production historically has not been a business with good returns. That being said it is an interesting company. If they really can keep increasing margins and volume the current price is a steal.